contra costa sales tax increase

And this change asserts the bill itself in Orwellian doublespeak does not constitute a change in but is declaratory of existing law. Steve Glazer D-Orinda that would authorize the county to impose a transactions and use tax of up to a half-cent for general or specific purposes to support countywide programs That bill would allow such a tax to pass with only a majority vote rather.

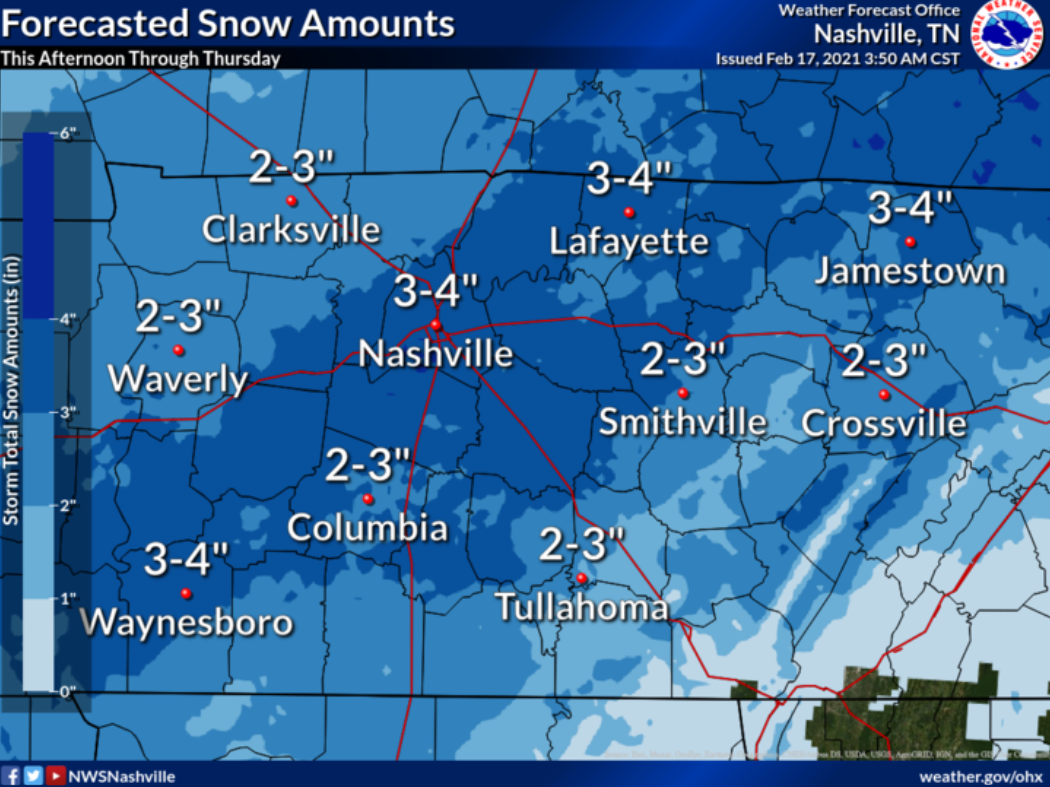

Dickson Weather Wednesday Snow Arrives In P M Some Convenience Centers Open

The Contra Costa County sales tax rate is.

. Are Dental Implants Tax Deductible In Ireland. Contra costa sales tax increase 2021. California has a 6 sales tax and Contra Costa County collects an additional 025 so the minimum sales tax rate in Contra Costa County is 625 not including any city or special district taxes.

This table shows the total sales tax rates for all cities and towns in. That leaves 1 remaining by which the county can. The minimum combined 2022 sales tax rate for Contra Costa County California is.

The Contra Costa County California sales tax is 825 consisting of 600 California state sales tax and 225 Contra Costa County local sales taxesThe local sales tax consists of a 025 county sales tax and a 200 special district sales tax used to fund transportation districts local attractions etc. This is the total of state and county sales tax rates. Its expected to generate almost 29 billion over that period of time.

Fund community health centers emergency response. The Contra Costa supervisors last month approved spending 10000 for a poll by the firm FM3 to help determine voter support for this sales tax measure. The 2018 united states supreme court decision in south dakota v.

6 Building 37 BusInd. The minimum combined 2022 sales tax rate for Contra Costa County California is. The Contra Costa County sales tax rate is.

The Contra Costa sales tax measure will depend on passage of state Senate Bill 1349 drafted by Sen. Supervisors on Tuesday heard the results of. 5 or possibly 4 in addition to the States 7.

State Senate Bill 1349 passed and signed at the last minute allows the Countys sales-tax cap to increase from 2 effectively to at least 3. The Contra Costa County supervisors last month approved spending 10000 for a poll by the firm FM3 Research to help determine voter support for the sales tax measure. Has impacted many state nexus laws and sales tax collection.

Contra Costa County is supposed to use the increased tax to fund essential services including the regional hospital community health centers emergency response safety-net services early. Contra Costa County Sales Tax Increase 2021. Measure X is a sales tax measure thats expected to generate 81 million dollars a year for the next 20 years.

Restaurants In Erie County Lawsuit. Majestic Life Church Service Times. 2 The city increased its existing tax of 050 percent GZGT to 100 percent GZTU and extended the expiration date to March 31 2044.

If it passes sales tax would increase by half a percent on most goods but not on necessities like food and medicine. Opry Mills Breakfast Restaurants. But District 1 Supervisor John Gioia of Richmond who has constantly defended the need for a countywide sales tax to support county services said The need is more apparent now that county services are underfunded and need additional tax support The tax increase would require support of a 50 plus one simple majority of voters to pass.

The 2018 United States Supreme Court decision in South Dakota v. State Senate Bill 1349 passed and signed at the last minute allows the Countys sales-tax cap to increase from 2 effectively to at least 3. Passes with a majority vote.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The California state sales tax rate is currently. The December 2020 total local sales tax rate was 8250.

Measure X a 20-year half-percent Contra Costa County sales tax increase is on the November 3rd ballot. Contra Costa County CA Sales Tax Rate Contra Costa County CA Sales Tax Rate The current total local sales tax rate in Contra Costa County CA is 8750. Contra Costa County was not alone tax proposals in Alameda Santa Clara San Mateo Marin and Solano counties also approved various tax hikes.

Food sales are exempt and the county estimates the tax would raise 81 million a year for the general fund. 5 ConsGoods 5 FoodDrug ADJUSTED FOR ECONOMIC DATA 1Q 2021 CONTRA COSTA COUNTY UNINC. The Contra Costa Board of Supervisors is likely to levy a 20-year half-cent sales tax proposal on the November ballot to make health and other critical resources more accessible and.

Measure X is a sales tax measure thats expected to generate 81 million dollars a year for the next 20 years. Support Placing Half-Cent Sales Tax Increase on Ballot on Split Vote The Supervisors on a 4-1 vote also flashed the green light to allow county officials to proceed in drafting a county-wide ballot measure possibly for the November election for a half-cent sales tax increase to support county services. 1 The city increased its existing tax of 050 percent CNCD to 100 percent CNTU in addition to the Contra Costa countywide increase of 050 percent listed in the countywide table.

The California state sales tax rate is currently. A yes vote supported authorizing an additional sales tax of 05 for 20 years generating an estimated 81 million per year for essential services including the regional hospital community health centers emergency response safety-net services early childhood services and protection of vulnerable populations thereby increasing the total sales tax rate in Contra Costa County. Restaurants In Matthews Nc That Deliver.

Now the agency plans to increase cultivation taxes 45 at the start of 2022. That includes the half-cent sales tax for BART and the additional half-cent sales tax for transportation through the Contra Costa Transportation Authority. A county-commissioned poll showed at least 59 percent support for the tax depending on various specific inclusions.

SALES TAX UPDATE STATEWIDE RESULTS The local one cent sales and use tax from sales occurring January through March was 95 higher than the. Uninc This Quarter 12 Fuel 24 Pools 5 Restaurants 6 AutosTrans. This is the total of state and county sales tax rates.

Thu feb 4 2021 1205 pm. The state has a sales tax rate of 725 decreased from 75 on January 1 2017 and state law prevented counties from charging more than 925 prior to the bill becoming law. That would bring Contra Costas sales-tax rate up to.

How To Scale An Online Clothing Business In 12 Steps

Sales Taxes How Much What Are They For And Who Raised Them

Sales Taxes How Much What Are They For And Who Raised Them

Used Whatsminer M21s 50t Or Miner M21s 52t Sha256 Miner Asic Btc Bch Bcc Mining Machine In 2021 Real Estate Investment Group Bitcoin Price Orange County Real Estate

Abc Board Head Shakes Up Sales Wilmingtonbiz Abc Shakes Headed

27 Keto Cauliflower Recipes That Are Low Carb And Actually Delicious Finance Sayings Health

Sales Taxes How Much What Are They For And Who Raised Them

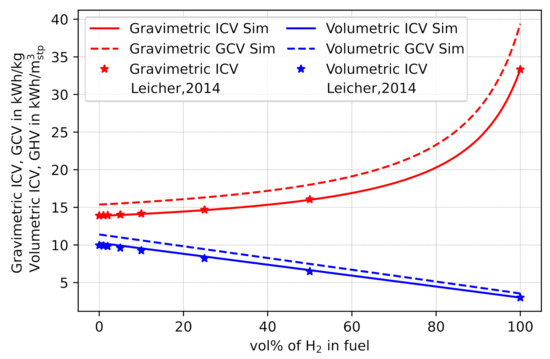

Energies December 2 2021 Browse Articles

Energies December 2 2021 Browse Articles

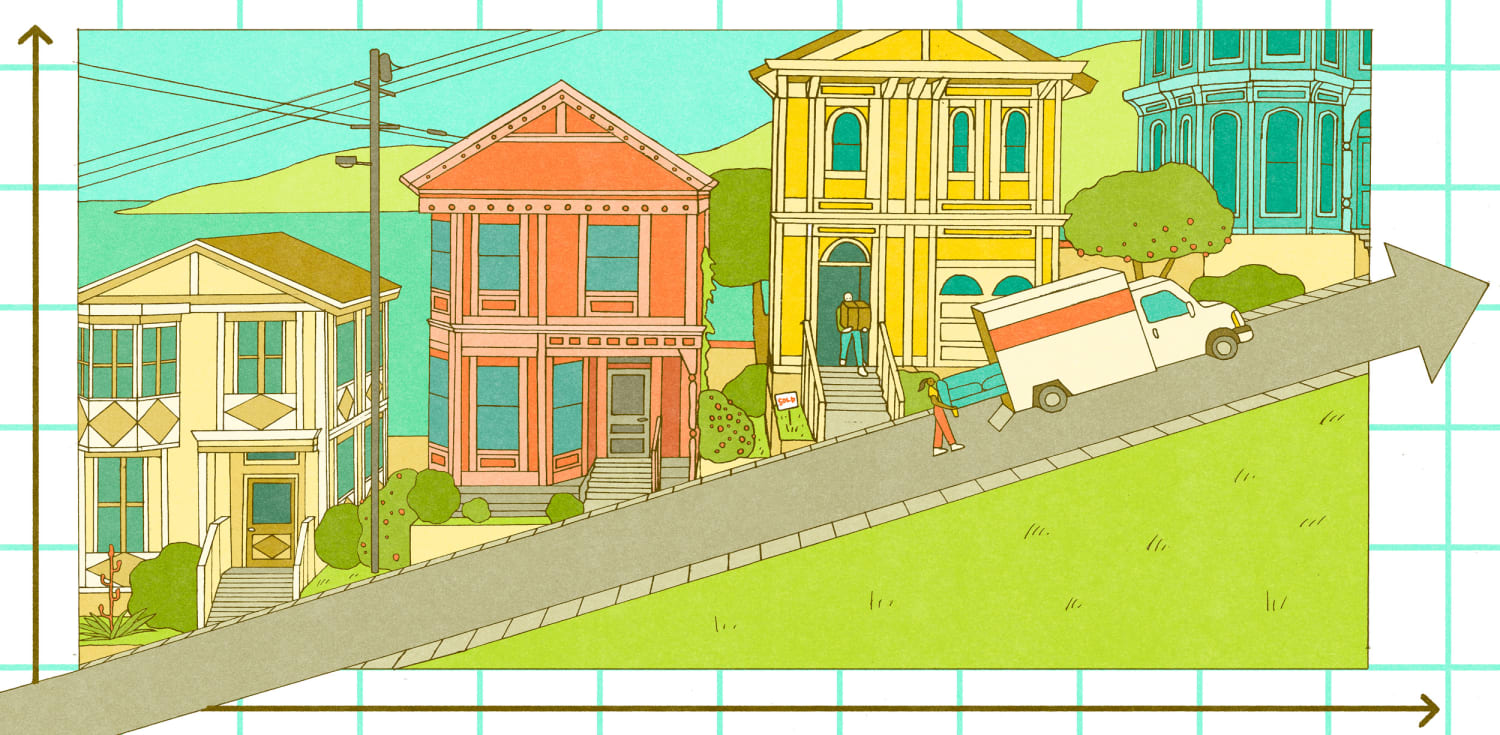

Bidding Wars And Meaningless List Prices Buying A House In The Bay Area

Used Whatsminer M21s 50t Or Miner M21s 52t Sha256 Miner Asic Btc Bch Bcc Mining Machine In 2021 Real Estate Investment Group Bitcoin Price Orange County Real Estate

Explosions Hit Military Base In Equatorial Guinea Many Feared Dead The New York Times

Special Offers And Promotions Lipoescultura Cirugia Plastica Tampa

Biggest Fish In The Sea Are Girls Eurekalert

3 Tips For Increasing Customer Value Davey Krista Increase Customers Creative Small Business Small Business Tips

Used Whatsminer M21s 50t Or Miner M21s 52t Sha256 Miner Asic Btc Bch Bcc Mining Machine In 2021 Real Estate Investment Group Bitcoin Price Orange County Real Estate

Sales Taxes How Much What Are They For And Who Raised Them

Dickson Weather Dickson County Schools Closed Again Thursday